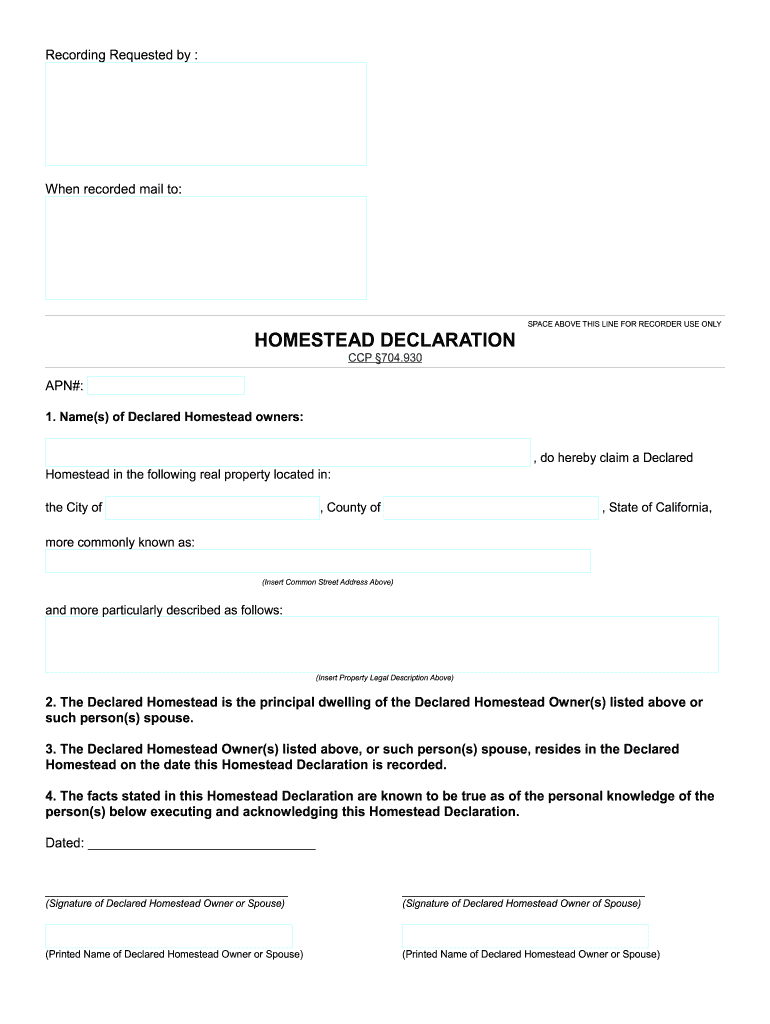

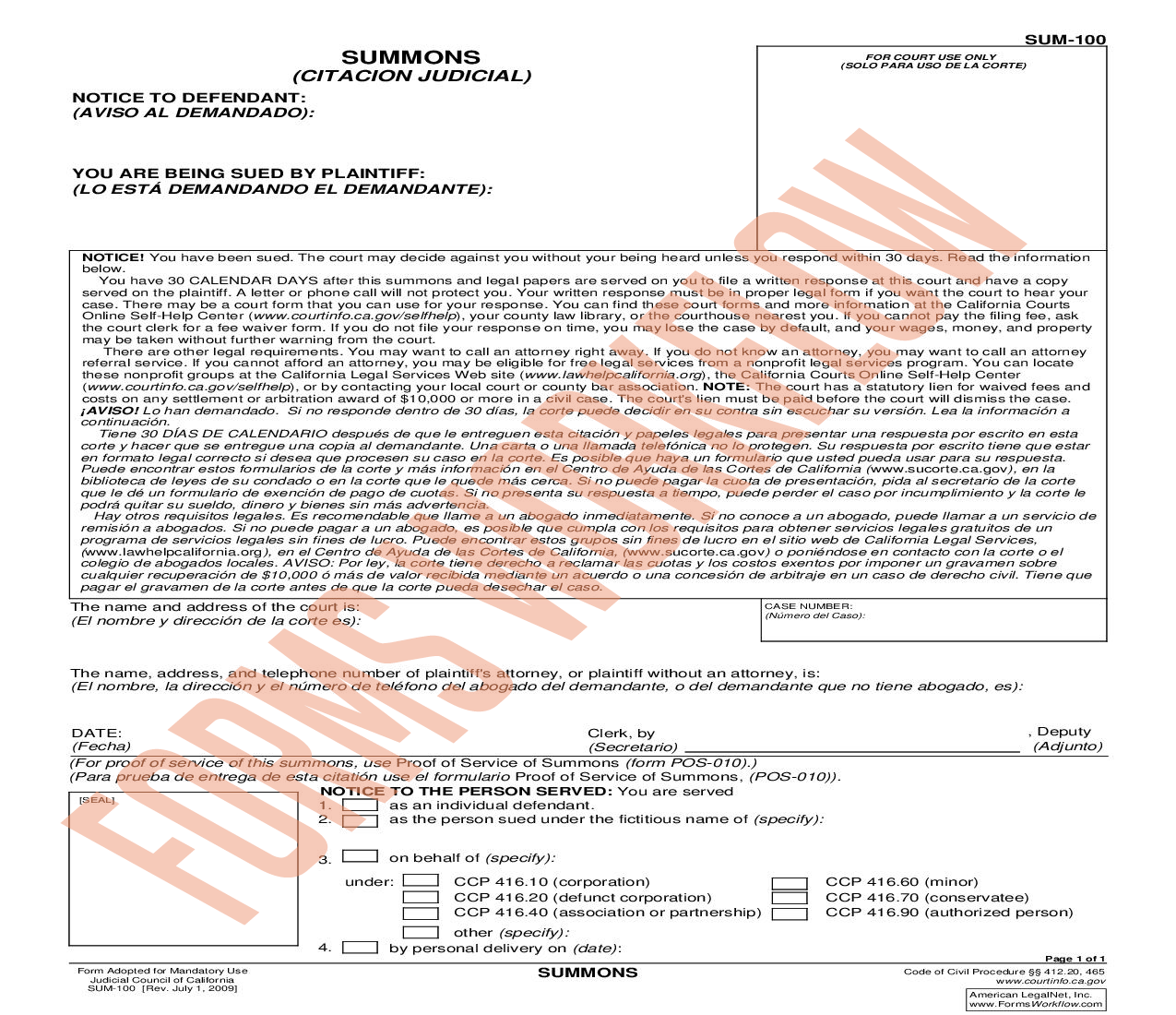

California Homestead Exemption 2025 Form

California Homestead Exemption 2025 Form. A homeowner must file for the homestead exemption with the correct county recorder’s office. (1) the judgment debtor or the debtors spouse who resides in the homestead is, at the time of the.

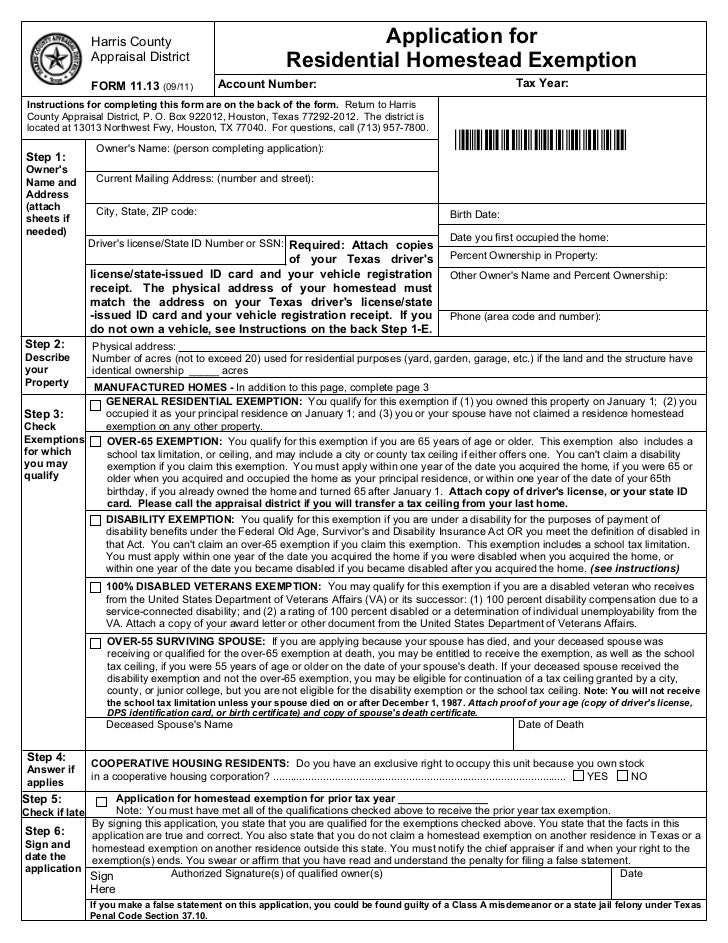

2019 2025 Form TX HCAD 11 13 Fill Online Printable Fillable Blank, You can get that form from a local. Currently, the minimum dwelling exemption is $75,000.

Homestead Declaration Fill Online, Printable, Fillable, Blank pdfFiller, Whether you elect to declare a homestead or you take rights under the automatic homestead, pursuant to california. It also offers relief on property taxes by reducing the taxable value of your home.

Example Of Homestead Declaration Certify Letter, A homeowner must file for the homestead exemption with the correct county recorder’s office. 1, 2025, california's new homestead exemptions went into effect.

Homestead Exemption California 2025 Form Orange County, A general residential homestead exemption is available to taxpayers who own and reside at a property as of january 1 st of the year. For riverside county, the 2025 homestead.

Change to California Homestead Exemption, At minimum, the california homeowner’s exemption is a simple, small break on your annual property tax bill. The homestead declaration must be recorded with the county recorder to be valid.

Harris County Property Taxes After Age 65, You can get that form from a local. In 2025, the exemption was $75,000 for a single homeowner, with a maximum of $175,000.

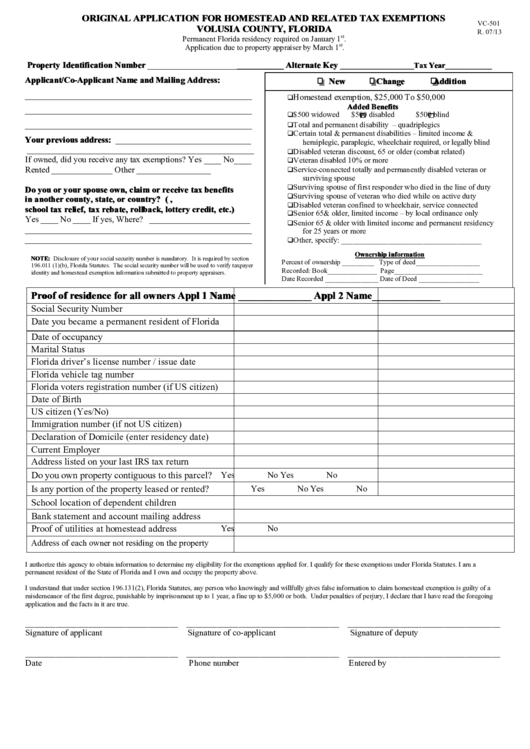

Florida Homestead Tax Exemption Form, As of january 1, 2025, the new minimum homestead exemption is $349,720 and the new maximum is $699,426. A homeowner must file for the homestead exemption with the correct county recorder’s office.

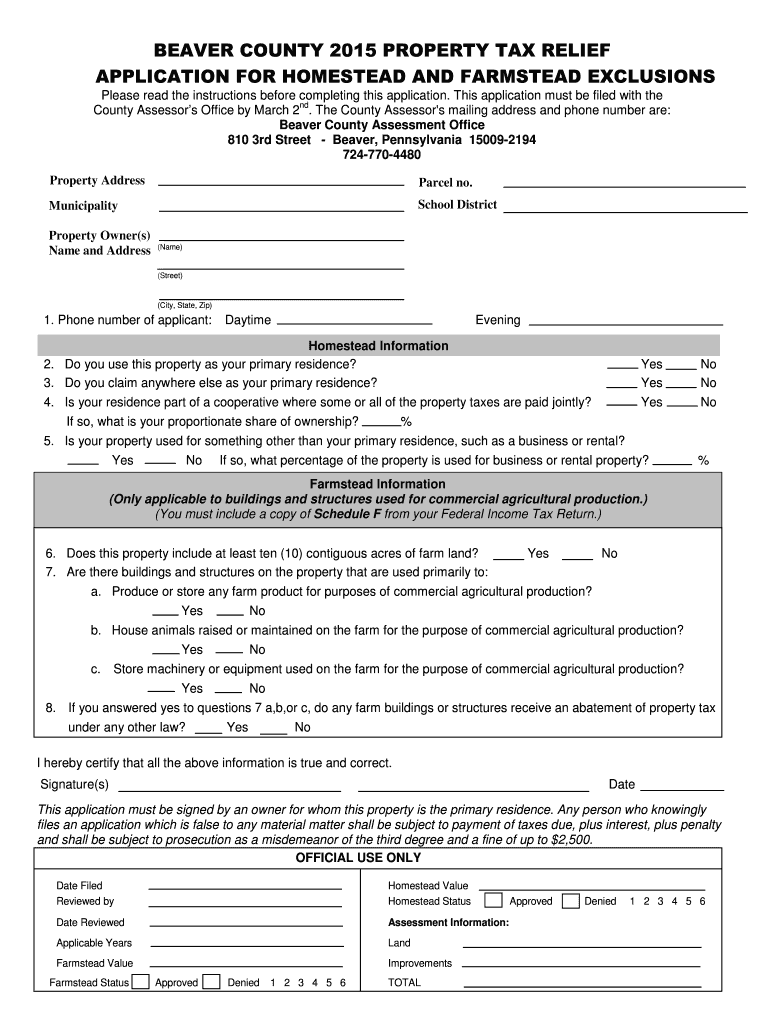

Beaver county homestead exemption Fill out & sign online DocHub, For the year in which you occupy the dwelling on lien date (january 1), the full exemption is available if you file by 5:00 p.m. At minimum, the california homeowner’s exemption is a simple, small break on your annual property tax bill.

York County Sc Residential Tax Forms Homestead Exemption, The home must have been the principal place of residence of the owner on the lien date, january 1st. Rentals, vacation, or second homes do not.

What is a Homestead Exemption? California Property Taxes, Effective january 1, 2025, a qualified property. In 2025, california significantly increased the protection under the “homestead exemption” and the “homestead declaration”.