How Much Is Self Employment Tax 2025

How Much Is Self Employment Tax 2025. You pay this tax on all wages, tips, and net earnings from. You’re going to learn about how.

You might think that you don’t have to worry about those payroll taxes if you work for yourself. Hm treasury analysis of tax liabilities.

Fastest SelfEmployment Tax Calculator for 2025 & 2025 Internal, Below, we’ll explore this tax and. Employee’s portion of social security tax for 2025 was 6.2%.

What Is the SelfEmployment Tax and How Do You Calculate It? Ramsey, Learn more about calculating all of your small business taxes. The tax amount can be a bit of a moving target, but.

A Beginner's Guide for SelfEmployment Tax TaxSlayer®, You pay this tax on all wages, tips, and net earnings from. The tax buoyancy decreased from 2.52 to 1.18 compared to the previous year.

Self Employment Tax Guide for Online Sellers — Tax Hack Accounting Group, Learn more about calculating all of your small business taxes. As of the tax year 2025, the fica tax rate is.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The tax buoyancy decreased from 2.52 to 1.18 compared to the previous year. You’re going to learn about how.

How to File SelfEmployment Taxes, Step by Step Your Guide, You pay this tax on all wages, tips, and net earnings from. £12,571 to £50,270 (basic rate) 40%:

How to calculate self employment tax YouTube, You pay this tax on all wages, tips, and net earnings from. Wage earners cannot deduct social security and medicare taxes.

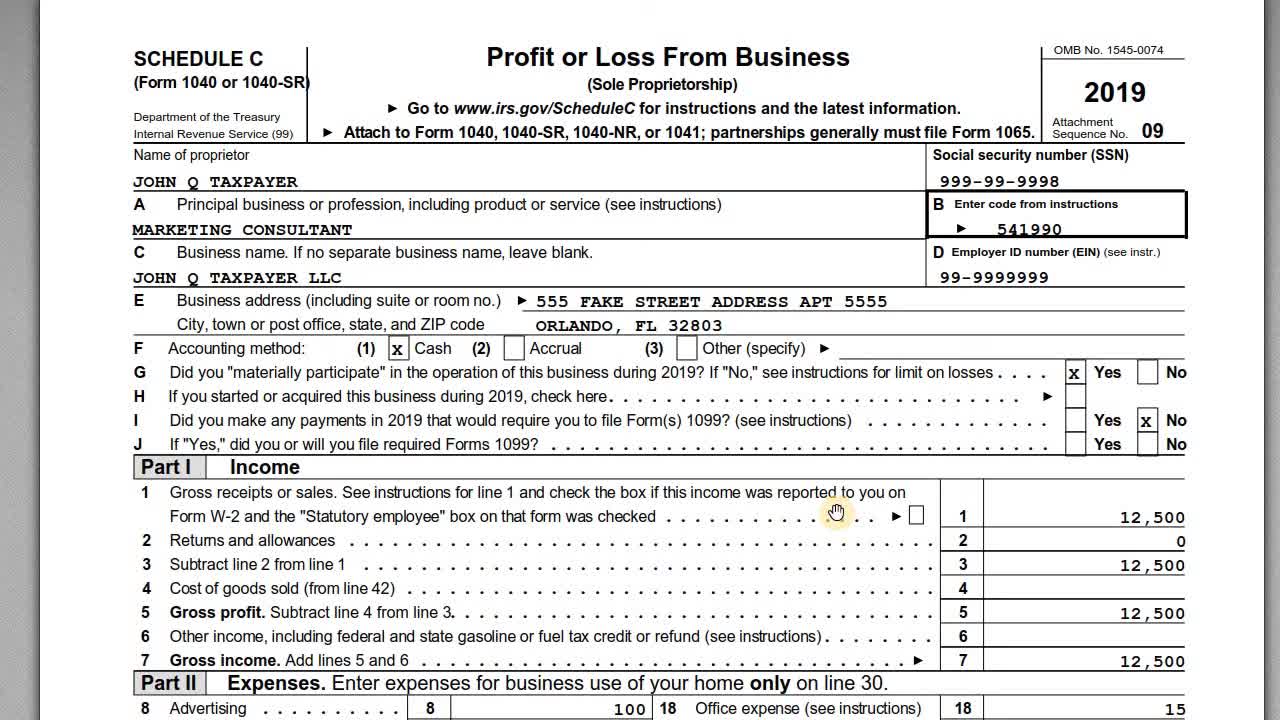

IRS Schedule C with Form 1040 Self Employment Taxes, But note that social security tax is applied on a maximum maxed. Below, we’ll explore this tax and.

Understanding the SelfEmployment Tax, You’re going to learn about how. The tax buoyancy decreased from 2.52 to 1.18 compared to the previous year.

How to File SelfEmployment Taxes, Step by Step Your Guide, Wage earners cannot deduct social security and medicare taxes. Tax buoyancy measures the efficiency of tax collection in response to gdp growth.